Rents are too damn high all over the country and they aren't coming down any time soon.

Recent research from the Harvard Joint Center for Housing Studies and Enterprise Community Partners, a real-estate research and investment organization, suggests that over the next 10 years, the rental population in the U.S. will climb by about 4 million people. (That’s actually a conservative estimate compared to the Urban Institute’s projections.)Another thing we're going to find out over the next decade is that the policy response (such as it is) has been wholly inadequate to meet the problem. Household incomes are not growing. That's something we've understood for a long time. Often we just allow the banks to fake their way through that by recklessly extending credit. We still do that, actually.

The researchers estimate that the current rental crunch—the one where vacancies are around 7 percent, about half of renters spend more than 30 percent of their salaries on housing, and one quarter spend 50 percent or more—is only going to get worse over the next decade. Even if housing prices and income rise as quickly as inflation (about 2 percent annually) the number of severely rent-burdened Americans (those paying 50 percent or more) would increase by 11 percent over the decade, to over 13 million people in 2025.

But an interesting thing happened the last time that blew up in everyone's face. The banks who created the credit fraud, ended up owning a lot of housing stock as a result.

The proposed merger of Starwood Waypoint and Colony is a bet that the percentage of Americans who own homes will remain unusually low. While the foreclosure crisis has receded, toughened lending standards have pushed millions of Americans out of the homebuying market.In some cases, banks are finding out that they kind of prefer being landlords to financing home ownership.

Higher interest rates would increase borrowing costs and make it harder for some renters to buy homes.

The Federal Reserve decided last week not to raise short-term interest rates from near zero, where they have held since 2008, but the central bank is expected to revisit the matter later this year.

The U.S. homeownership rate is at its lowest level in nearly 50 years, falling to 63.5% in the second quarter, according to the Commerce Department.

In contrast, single-family rentals now add up to 13% of overall housing stock, up from 9% in 2005, according to a report by Moody’s Analytics.

Rents have been climbing steadily, though some analysts and investors question how long it can last, especially in areas with weak wage growth. Many of the rental homes scooped up by big investors are in those parts of the U.S.

It was widely deemed a temporary play: Large-scale investors buying thousands of discounted foreclosed properties during the worst of the housing crash and turning them into single-family rentals. When home prices recovered, they would surely sell them for a hefty profit. The housing market is recovering, albeit more slowly than expected. Foreclosure volume is way down and home prices are way up, but these investors are not selling.There are a number of negative effects we can focus on here.

They are buying more, and now they are buying new.

"I actually think that we're coming into perhaps the most compelling three or four years that I've seen since I've been in the business," said Doug Brien, CEO of Starwood Waypoint Residential Trust.

Banks, hedge funds, and private equity firms have been amassing those real estate holdings for a few years now, but their plan for wringing profit out of the rental market is just starting to draw real scrutiny. The New York-based hedge fund Blackstone Group is now the nation’s largest landlord after purchasing over 40,000 foreclosed family homes for the purpose of renting them out.But essentially we're looking (again) at a case of financial intermediaries serving to further concentrate wealth among the investor class rather than help purpose it toward the betterment of individual lower or middle class households.

While firms like Blackstone often farm out the day-to-day management of the rental properties to third-party companies, those intermediaries are often also based in faraway states. Some have a track record of being unresponsive to basic things like broken sewer pipes, as the Huffington Post has reported. The banks and their intermediaries may neglect basic upkeep of these properties. In that worst-case scenario for renters, local and attentive property managers and building supers will get replaced with “Wall Street-based absentee slumlords,” in David Dayen’s phrase.

On-the-ground concerns for communities and renters go beyond neglect, however. The rising influence of financial titans turned local landlords could threaten all sorts of public services. In the case of Huber Heights, OH, the hedge fund Magnetar Capital has become the largest landlord in the whole town and is using that influence to try to extract lower property tax charges from the town — a change that would undermine funding for schools and other public services for locals, but boost the bottom line of the Illinois-based financial giant. (Magnetar’s dodgy past dealings from the subprime era also underscore an unsettling dynamic to Wall Street’s entry into the rental market: the same companies that helped turn homeowners into renters through mass foreclosures are now preparing to make even more money off of the same rental demand they helped create.)

A reasonable policy response might attack that problem directly; perhaps by writing rules that de-commodify housing or at least limit banks' capacity to act as mega-landlords, or by imposing rent controls in neighborhoods threatened by gentrification, or even by building more public housing.

Of course, we are doing none of that. Instead we are, as The Advocate editorial board says, waiting for "the market" to fix everything for us. But why would it? Incomes are stagnant. But we already know that the local labor market is decoupled from the local real estate market. We also know that the market for affordable housing is tightening but all we seem to do is build more and more nice things for rich people.

Developers building condos on the site of the old Hubig's Pie factory in the Marigny are now turning to a plum piece of riverfront property in the Bywater.In the Bywater, of course. But also Uptown.

MK RED, a partnership of Michael Bosio and Kyle Resmondo, plans to build a 55-foot, $8 million condo building with 16 residences on vacant land near the Piety Street archway bridge into Crescent Park.

They bought the property at 3200 Chartres St. in August for $1.35 million.

"It's everything going on in the Bywater," Bosio said. "You have great food locations down there. You have the new park and of course, the views. You get the whole city skyline."

Phyllis Landrieu, a former Orleans Parish School Board member and aunt of the mayor, plans to replace two small homes at the corner of St. Charles Avenue with a 57-foot-tall condo building with 10 units inside. Landrieu and her supporters said that the two “ranch-style” homes are out of character with the grand nature of St. Charles Avenue, and that the proposed building will enhance the avenue’s appearance.

Landrieu’s building would be adjacent to another condo building in the same block, and it was residents of that structure who provided the most opposition to her proposal. They said they had a petition of 90 neighbors in opposition, and argued that the new building will take up too much of the lot and be too close to their building.

Elsewhere uptown.

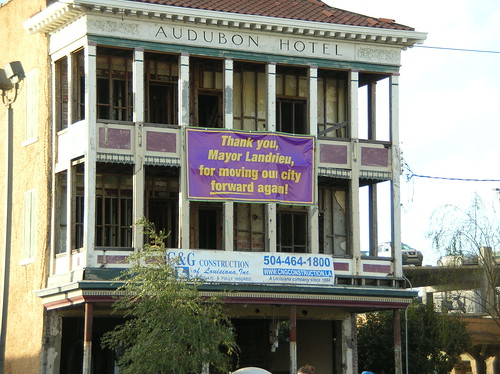

Chris Jones, his wife Jessica Walker, and David Gindin described their vision for the redevelopment of the Audubon Hotel to the Coliseum Square Association as a 30-room boutique hotel designed to attract a younger, more international clientele. Their renovation will actually reduce the number of rooms in the building somewhat, because the older floor plans had shared bathrooms, and they intend to put a bathroom in every room.Hey.. it's "back in commerce" and good for "the security of the area." That seems to be all we care about lately. What we don't care much about, though, is whether or not we have an affordable housing strategy. This is trickle-down economic policy. It will help enrich some New Orleans developers and some out of town investors and.. as you can see.. some Landrieus. But, no matter what the various mouthpieces and politicians involved tell you, it is not going to help relieve the problem of too-damn-high rents in New Orleans.

The hotel does not have room for a restaurant, but its front desk will double as a small bar, Gindin explained. It will also be staffed 24 hours a day, he said.

“I think that’ll contribute a little bit to the security of the area,” Gindin said. “That part of St. Charles does have some issues, but part of the problem is you have an abandoned building there.”

No comments:

Post a Comment